Boost your buying power with margin trading

Use cash or securities as leverage to increase your buying power, fully Shariah-compliant to trade stocks in the Saudi market.

Lowest minimum requirements

Diversify your trading strategy

No hidden fees

Fully Shariah compliant

How can Margins help you?

What are Margins?

Margins are funds set aside as security to trade bigger with borrowed money.

How do I use them?

Deposit a small amount to access larger trades.

How will they help me?

Invest more while using less of your own money, boosting your buying power and potential profits.

Get low entry requirements and high liquidity

Discover our diverse margin options and choose the one that best suits you.

|

Free Margin |

Free Margin Trading |

Murabha Margin |

|

|---|---|---|---|

| Ideal for | |||

|

Ideal for

|

Active traders with daily or semi-daily trading activity |

Active traders who trade 8 times a month |

For long-term investors |

| Minimum | |||

|

Minimum

|

10,000 SAR |

10,000 SAR |

10,000 SAR |

| Trading commission | |||

|

Trading commission

|

Upon request |

0% |

Upon request |

| Margin cost | |||

|

Margin cost

|

- |

- |

Free |

| Contract | |||

|

Contract

|

Monthly |

Monthly |

Yearly |

| Leverage available | |||

|

Leverage available

|

1:1 |

1:1 |

1:1 |

Key margin ratios to understand

Learn how your capital compares to the total portfolio value, Including margin when margin is issued.

Initial Margin Ratio

This is the ratio of the client’s capital to the total portfolio value (including margin) at the time the margin is issued

-

Ratio for (1:1) Client

At inception, the ratio is 50% of the total portfolio value

-

Result

Allow the transfer of any profit above the initial capital when profits exceed.

Maintenance Margin Ratio

The ratio of the client’s capital to the total portfolio value (including margin). If this ratio is reached, it will trigger a reduction in the client’s buying power

-

Ratio for (1:1) Client

Activate the maintenance margin when the capital-to-portfolio ratio falls to 40%, reflecting a loss.

-

Result

Reduce client buying power based on the loss in total portfolio value.

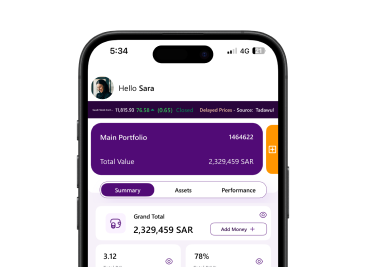

Get started in 3 steps

1 Download the Derayah app

Access your Derayah account

Choose your margin type

Discover more products

Derayah Local Trade

Ready to invest in Saudi and MENA markets?

Derayah Global Trade

Ready to invest in 31+ countries around the world?

Frequently Asked Questions

You can browse frequently asked questions about this service.

If your question is not available here, You can contact us.

Can I get a margin through Derayah platform?

Absolutely! You can get margin through Derayah platform. However, it is exclusively for trading in the Saudi market.

How to get Murabaha margin?

You can get it by submitting a Murabaha margin request through the Derayah platform.

What is the minimum requirement for Murabaha margin?

The minimum amount to apply for Murabaha margin is 10,000 riyals.

What markets are available for trading using Murabaha margin?

The Saudi market

Are there additional fees for Murabaha margin?

There are no additional fees (except for financing fees) to obtain Murabaha margin.

What is the settlement periods T + 2?

Cash settlements refer to the process of transferring the value of securities for executed transactions from the buyer’s investment account to the seller’s investment account, through the exchange members.

For further reading, please visit the Tadawul website on: https://www.tadawul.com.sa/wps/portal/tadawul/knowledge-center/about/settlement-cycle?locale=en